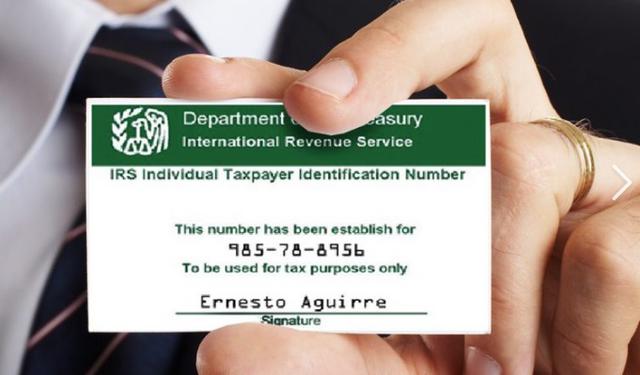

ITINs were created to allow persons who are not authorized to work in the U.S. to be able to file federal income tax returns. For example, a foreign investor who is an inactive partner in a U.S. company but not authorized to work in the U.S., must use an ITIN to file a return to pay federal tax. ITIN numbers look like social security numbers, but are easily identified because all ITINs start with the number "9."

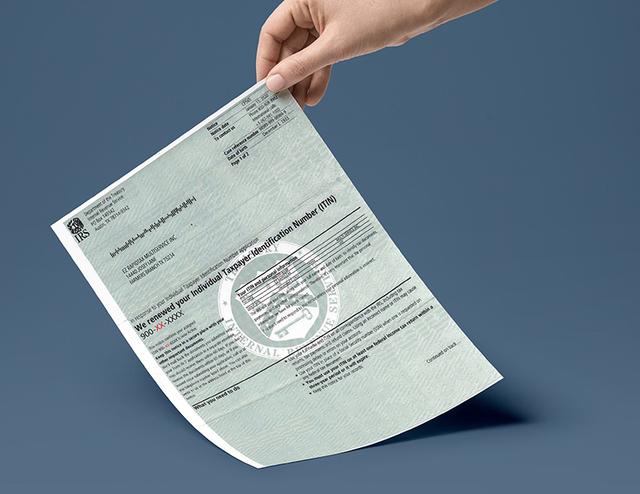

Because ITIN cards were often mistaken for social security cards, the IRS began issuing ITINs by letter.

The IRS breaks its own rules by accepting ITINs in place of Social Security numbers and directs banks to accept ITINs in place of social security numbers.

To shift responsibility of misuse, the IRS in 2003 issued letters to all governors and state motor vehicle departments advising that ITINs were not designed to serve as personal identification and would not be suitable for determining identification of applicants for driver’s licenses. see IRS web page (5th paragraph). But California and some other sanctuary states have ignored the IRS warning and issue drivers licenses based on the ITIN anyway.

---- END ----

ITIN (Individual Tax payer Identification Number)

EARLY CARD VERSION

UPDATED LETTER VERSION